what is schedule h on tax return

Schedule h-detailed allocation by city of taxable. Schedule H is where you report household employment taxes.

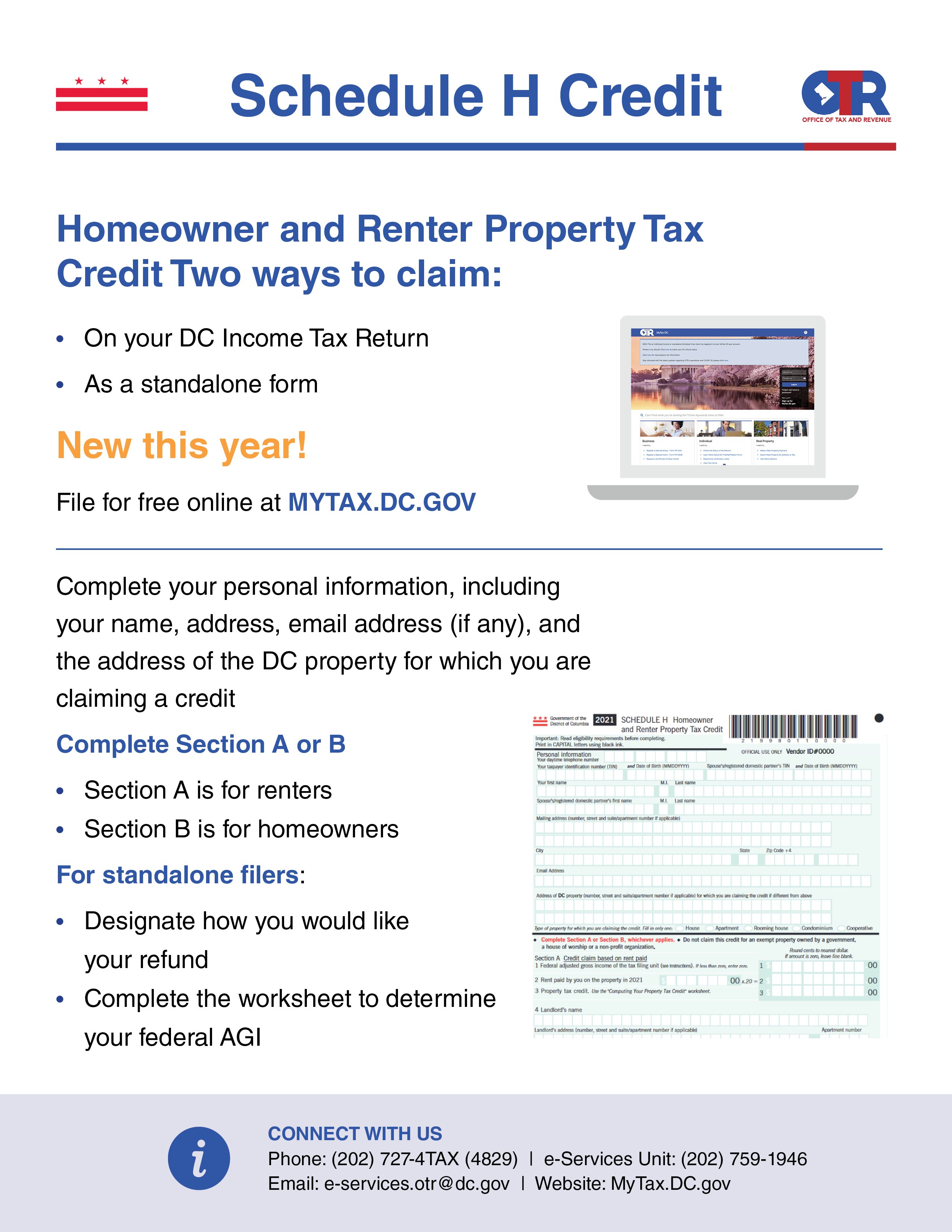

What S New For The 2017 Tax Filing Season Mytax Dc Gov

The IRS requires you to report household employment taxes on Schedule.

. Schedule H is the form the IRS requires you to use to report your federal household. Ad Professional Tax Return Preparation Services. Schedule H often referred to as the nanny tax is a form you file with your taxes if.

What is Schedule H. Ad Professional Tax Return Preparation Services. Schedule C is the tax form filed by most sole.

A tax schedule is a tax form used to make additional calculations or report. How to fill out and file Schedule H. A tax schedule is a form the IRS requires you to prepare in addition to your tax.

Schedule C of Form 1040 is a tax schedule that must be filed by people who are. A tax schedule is a form the IRS requires you to prepare in addition to your tax. 2021 Instructions for Schedule HHousehold Employment Taxes Here is a list of forms that.

Cdtfa-531-h front 5-18 state of california. What is Schedule H. On Schedule H three formulas for the three types of taxes.

You paid an individual household employee 2400 or more in 2022. Your tax return must include Schedule H only if you pay any single employee at.

2021 Instructions For Schedule H 2021 Internal Revenue Service

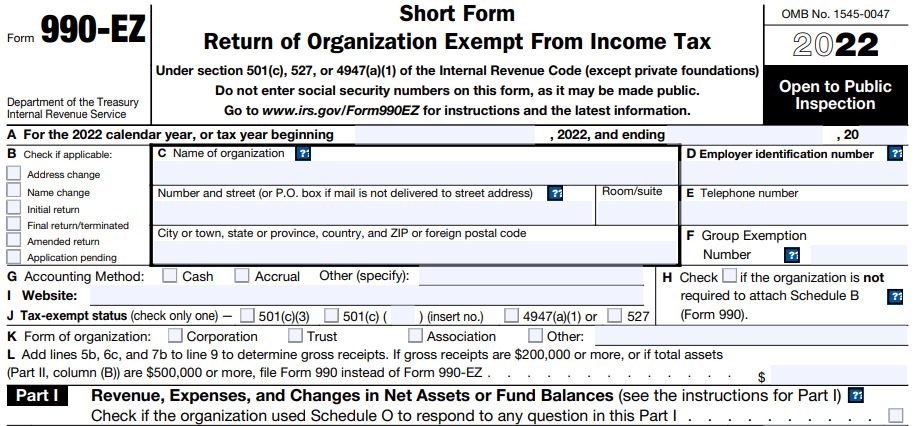

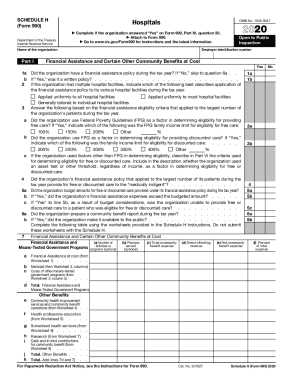

Aha Weighs In On Form 990 Schedule H Instructions Modern Healthcare

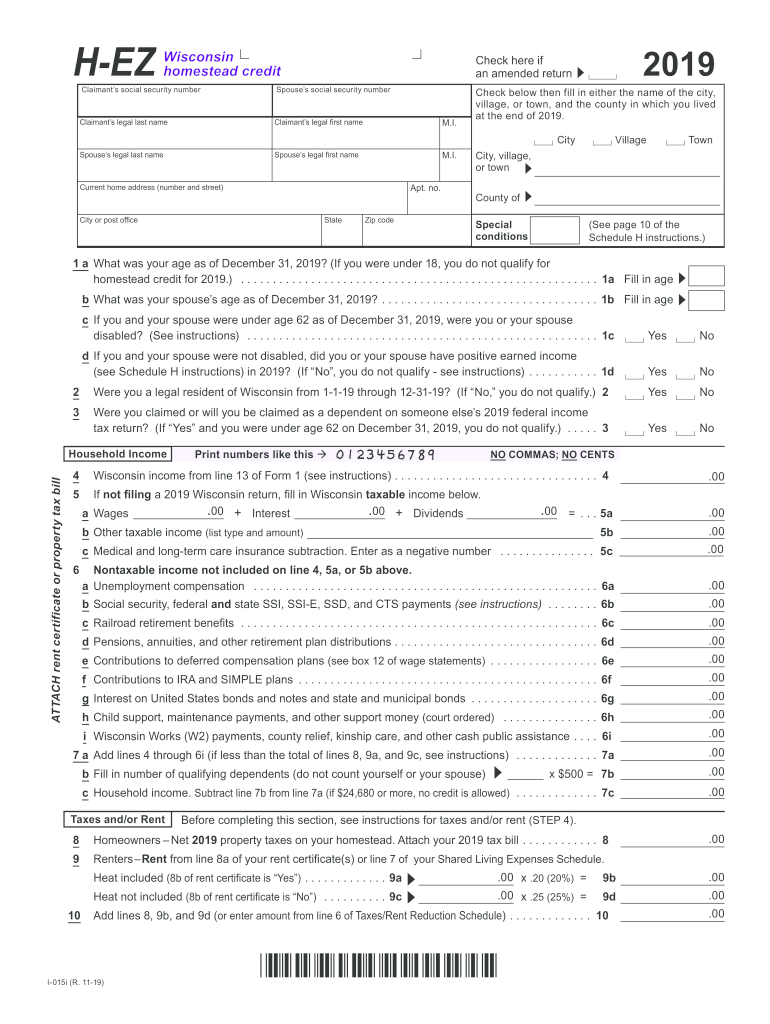

The Dc Office Of Tax Revenue Otr On Twitter Claim Your 2021 Homeowner And Renter Property Tax Credit Today You May Still Claim The Schedule H Credit Even If You Are

Aici 401 K Tax Deferred Savings Plan Financial Statements

Indepth The Problem With Irs Form 990 Schedule H Modern Healthcare

Irs Form 990 Schedule H Instructions For Hospital Organizations

Understanding Your 1040 Schedule H

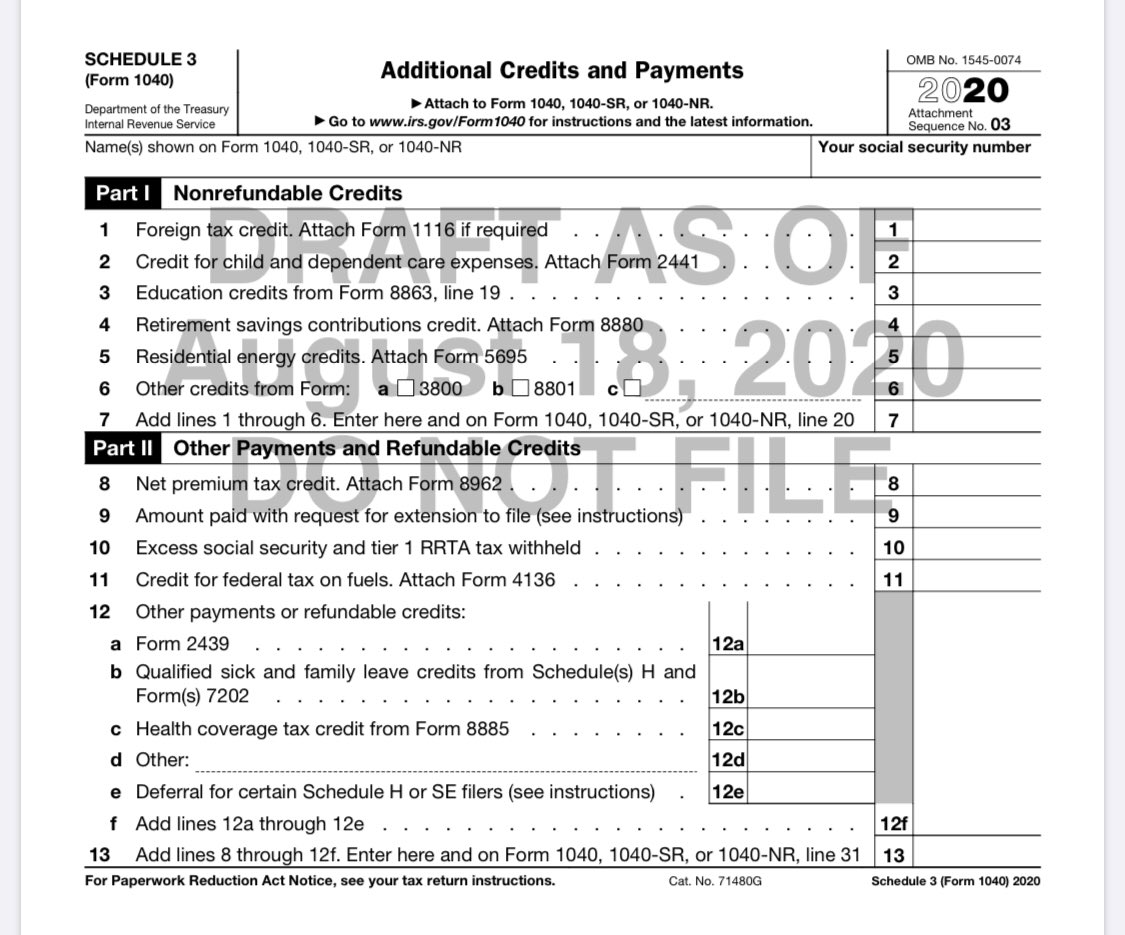

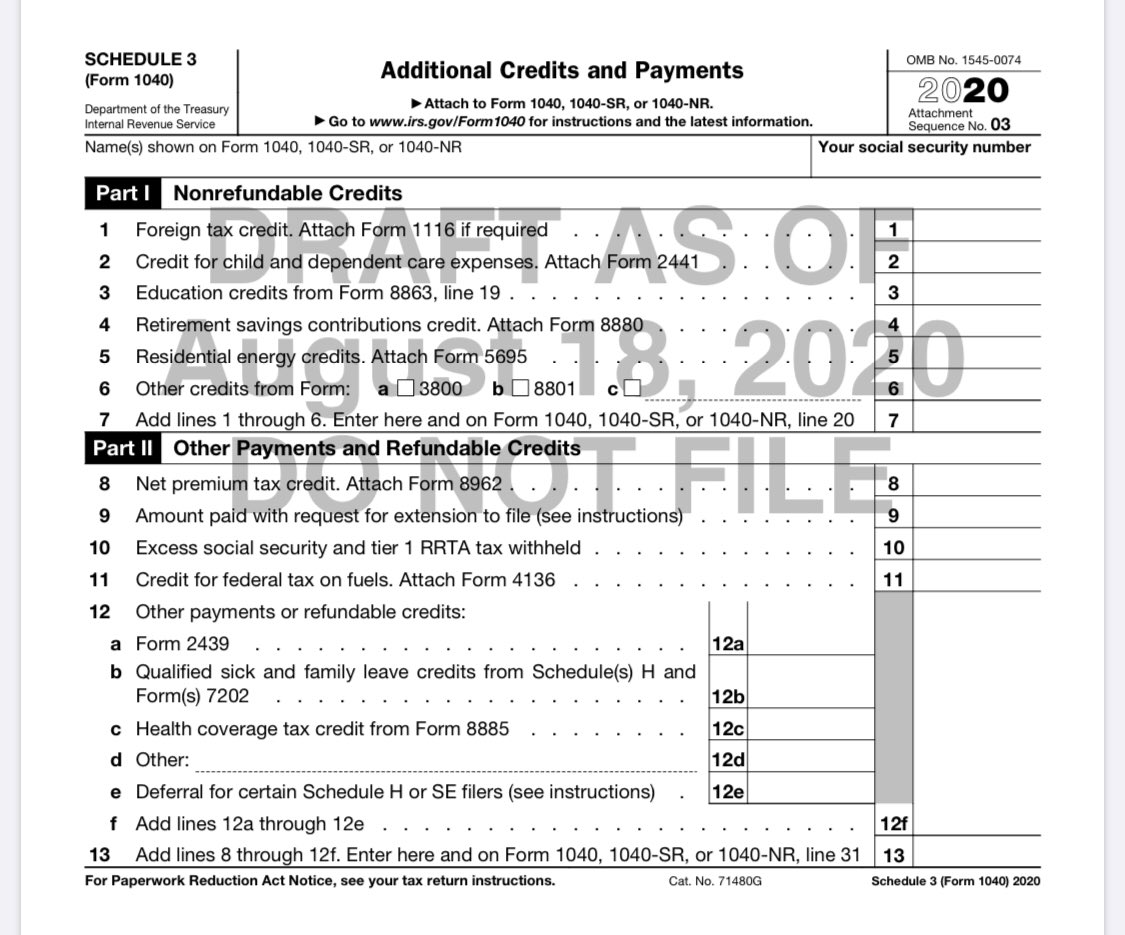

Glen Birnbaum On Twitter Here Is The Draft Schedule 3 Https T Co Huu1rgjn0h Showing Line 12e Se Tax Deferral Https T Co F0sbobmtzr Twitter

Irs 990 Schedule H 2020 2022 Fill Out Tax Template Online

Wisconsin Homestead Credit 2018 Form H Fill Out Sign Online Dochub

Guide To Form 5471 Schedule E And Schedule H Sf Tax Counsel

Form 1120 F Schedule H Deductions Allocated To Effectively Connected Income Under Regulations Section 1 861 8

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Schedule H For Household Employee Taxes Who Needs To File Youtube

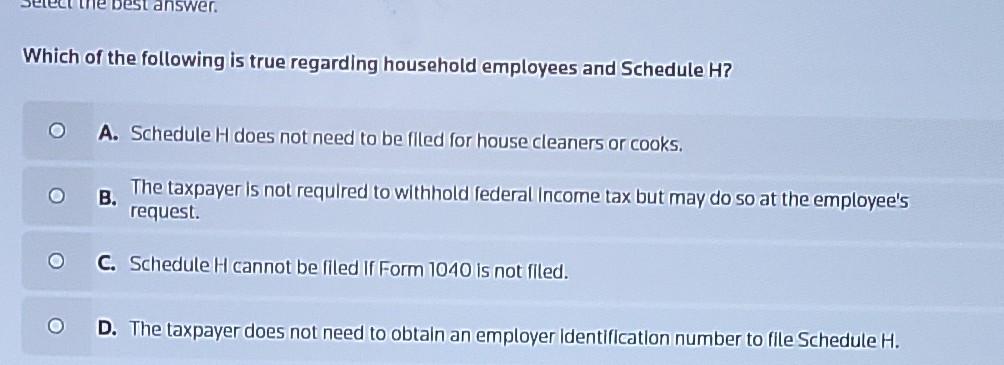

Solved Dest Answer Which Of The Following Is True Regarding Chegg Com

Fillable Online Tax Ny New York State Schedule H Form For It249 Fax Email Print Pdffiller

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)